Potential Redevelopment for Condo Buildings

South Florida Business Journal // July 9, 2021

By Brian Bandell

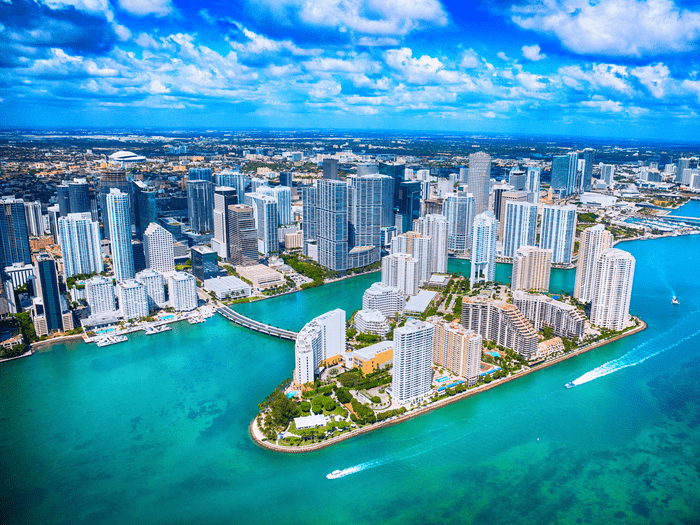

The deadly collapse of a condo in Surfside has brought the issue of delayed repairs on older residential towers to the forefront, and owners who can’t afford repairs may opt to terminate their associations and sell to a developer.

This could accelerate a trend that’s been going on for years: developers buying out older condos in prime locations to redevelop them into luxury residential projects with higher price points.

After Champlain Towers South, built along the ocean in 1981, fell June 24 with structural damage that was left unchecked, cities across South Florida are cracking down on delayed maintenance and unsafe conditions in older condos.

As investigations began, North Miami Beach officials made residents of the Crestview Towers evacuate July 2 because an inspection found the building “structurally and electrically unsafe.” Other cities, such as Miami Beach and Sunny Isles Beach, have started inspecting buildings that need to undergo the 40-year recertification process.

That means condo owners who have delayed repairs for years are likely to see the bill come due soon. The question is whether they can afford them: Special assessments of $80,000 or $100,000 could be looming for some unit owners, experts say.

“I’m sure there will be a number of buildings where they can’t afford assessments to bring those buildings up to snuff,” said Ronnie Krongold, CEO of Miami-based developer Gold Krown. “If the damage assessment is 60% of the value of the unit, the owner needs to think about whether the association will accept a developer’s offer.”

Gold Krown recently bought out a 25-unit condo built in 1959 on the Isle of Venice in Fort Lauderdale. After the 40-year recertification inspection, the condo owners decided the repair bill was too much, so they decided to sell. Now, Gold Krown is building a 16-unit condo called 160 Marina Bay there.

As 40-year recertifications are conducted on older buildings and owners realize they can’t put off repairs, the properties could be prime opportunities for redevelopment, Krongold said.

Some owners of older condos are on fixed incomes and can’t afford huge special assessments for repairs, said Adam Mopsick, CEO of Miami-based Amicon, which manages construction projects for condo associations. Buildings with fewer units are more vulnerable to special assessments because the cost of repairs is spread among fewer owners. Plus, the cost of construction is increasing, he said.

“Those assessments may cause buyers not to want to buy units,” Mopsick said. “These people can get stuck.”

Charging assessments is unpopular, so many older condos have put off repairs for years, allowing the costs to pile up. Mopsick expects building officials won’t let that continue. Luxury buildings with wealthier owners may be able to take out financing and make repairs. Others could find selling to a developer is a better option, he said.

Certain developers and Realtors keep close tabs on associations in older condos to see if they would be open to a bulk sale, said attorney Daniel Diaz Leyva, of Miami-based Diaz Leyva Group.

He previously helped Fortune International Group buy out and terminate a condo in Miami Beach. Developers are often willing to pay above market value for these condos, Leyva said. Instead of paying a special assessment of $100,000 to repair the structural elements of the building — which won’t increase the value of the owner’s condo much — and living through years of construction, the owner could sell and move on at a potential profit, he said.

Of course, even if an owner can sell their unit at above-market value, the price may not grant them access to a condo in the same coastal neighborhood as residential prices rise rapidly in South Florida.

“You always run into some holdouts who say, ‘I’m 80 and I moved down here from New York and I want to die in this condo on the beach,” Diaz Leyva said.

In many cases, condo associations charge hefty assessments for repairs and some unit owners simply can’t afford it. The associations can place liens on the condos and foreclosure on them, putting the owner at risk of losing their equity, said attorney Ira Teicher, a partner in the real estate group at Miami-based Stroock. Selling the condo is difficult because buyers will likely demand a discount because of the special assessment, he added.

That could create an opportunity for investors to purchase condos in an older building in need of repairs at a discount, expecting that they will increase in value when the repairs are completed, Teicher said.

Even if a developer can’t buy all of the units and terminate the condo right away, there are ways to achieve that goal gradually. Teicher said some developers acquire enough units to gain a majority of seats on the association, and then pass special assessments on the remaining unit owners to price them out.

“If a developer has the stomach for it, they can have the ability to buy out the whole building, which is not easy,” Teicher said.

Alicia Cervera Lamadrid, managing partner of Miami-based residential brokerage Cervera Real Estate, said some older condos are better off being terminated because of the high cost of repairs and lower unit values compared to new buildings. The units are often worth more as a whole than individually because of the value of the land.

However, changes in state law four years ago made it more difficult to terminate a condo by raising the threshold of members required to vote on the measure.

The 2017 laws were passed largely in response to individual condo owners who had their properties terminated despite their objections. It allowed at least 5% of condo owners to defeat a termination measure, unless the declaration of the condo association had a different requirement.

Getting condo owners to agree on anything is challenging, but some developers have secured 100% votes on terminations, said Martin Schwartz, a real estate partner at Bilzin Sumberg in Miami. That will prevent a large wave of terminations, but owners may be more receptive to the idea than before.

“After what happened, owners would say we don’t want to be in the position of Champlain Towers, so maybe we should sell it to a developer,” Schwartz said. “Maybe this will change the minds of people who bought it 20 years ago and intended to die in this unit.”